In this write up, I intend to showcase the real and often unimagined impact of cost overshoots on housing loan customers. For the purpose of this article, we will ignore the margin money portion and only consider the asset worth the housing loan portion – i.e. when I say cost of the house, it means the housing loan amount.

Typically, a 5-10% impact in total cost might result in a 10-20% increase in housing loan amount, and I have taken scenarios to illustrate 10 and 20% changes in the housing loan amount due to cost being managed better. The impact of such unfactored cost escalation on your financial well being over the future years of repayment, is quite larger than what is perceived at first glance.

Impact of cost escalation on housing loan total repayment value

Let us say you are building a home for Rs.52 Lakhs. Wherein you have Rs.20 Lakhs, and are taking the rest of the amount as loan. We’ll consider the impact on housing loans and repayment if it becomes Rs.56 Lakhs (Rs.36lakh loan), and if it becomes Rs.60 lakhs (Rs.40 Lakh loan, which let us say is your maximum eligibility). In this scenario with cost escalation, you end up taking a housing loan based on your maximum repayment capacity, repayable over 30 years @ Rs. 31k per month- EMI. Let us compare it against how it would have been if you had a 4Lakh – 10% lesser housing loan number vs an 8Lakh – 20% lesser number due to effective cost monitoring and prevention of cost escalation.

In principle, the time value of money is considered, and if you discount the amounts all to the current date, of course you will reach the same numbers of 10% and 20% differences. But then, how does this actually transpire for you in terms of repayment and home ownership/principal repayment?

When you construct a house by availing home loan, the house is mortgaged to the financier. Financier has the right to take possession and sell it to realize the loan dues in case of default. Theoretically, you are gradually retrieving the whole right on the house as you repay the loan. But repayment of, say 50% of the EMIs, doesn’t buy you back 50% of the house. Because, most of the money you pay by EMIs would actually be counted towards interest and not principal. This makes some differences which are not apparent to the common borrowers.

Illustration

| Total Loan Amount | EMI | Tenure (Months) | Total Outlay | Savings in terms of cash outflow* | Savings and % of planned cost |

| 40,00,000 | 31,040 | 360 | 1,11,74,400 | – | 0% |

| 36,00,000 | 31,182 | 246 | 76,70,772 | 35,03,628 | 109% |

| 32,00,000 | 31,700 | 180 | 57,06,000 | 54,68,400 | 171% |

* If you discount this to present value at housing loan rate, of course this will equal present saving number only

In the chart here, you can see the comparison between your total outlay in terms of cash, assuming you pay the same amount of EMI in all cases. You will end up paying Rs. 54Lakhs extra in case of the 40Lakh loan(with 20% more cost), and 35 Lakhs extra in case of the 36Lakh loan(with 10% more cost), as compared to the 32Lakh loan(with effective cost management). In the first case, the extra repayment is 171% (almost double) the cost of your house itself !

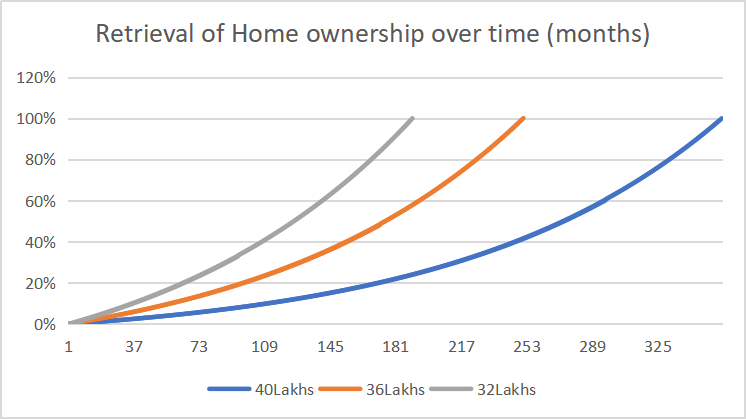

Impact of cost overrun on ownership retrieval time period

Here is the equity ownership retrieval of the home (principal repayment), plotted over time. As you can see, in about 15 years, the INR 32 lakh loan guy makes the home his own by freeing up all charges of the financier. Whereas the INR 40 lakh loan guy barely has 20% of the house in his name! Even the INR 36 lakh guy only has about 50% of the asset value repaid! Imagine the scenario that you want to sell this house off to meet some unforeseen expenditure in the family. Or you want to reinvest after 15 years due to some unforeseen reasons. We can clearly see the impact is really high!

Summary

What does this mean for you? It means that, you should spend considerable time and effort to get your planning and budgeting right. You should make sure your cost estimation or BOQ has everything you need, before beginning the project and finalizing your housing loan amount.

You should also ensure your chosen construction partner is capable. In addition, they manage the project in such a way that there is no cost overrun. Ultimately, getting the planned amount right and sticking to it will save you a lot of money in future. It will also help you take full ownership of your home much faster!

Are you planning to take housing loan to finance your project? If so, are you planning well to ensure there is no cost overrun for your project?

Great article, mind-blowing numbers and illustration.